Part 2: Precipitous Drop in Standard of Living just on the Horizon

Common thieves masquerading as 'experts'. Where have we heard that one before...

If you haven’t yet read Part 1, you can find it above.

If you have $100 in your pocket, but next week you can only buy $90 worth of items with it, where did the missing $10 go? You’re already feeling this, but you should know that it’s not going anywhere — and in fact, all the conditions are present for it to get worse. How much worse is hard to speculate on, but in this way, the Federal Reserve and its Member Banks are working in concert to evaporate the savings and livelihood of the American people — much as a highway robber or common thief would pick your pocket. Masquerading as ‘experts’ (where have we heard that before..?) the ‘economist’ class is currently picking the collective pocket of the American people and are no better or different then the common thieves and criminals who would steal your hard-earned money for nothing.

Calculations shared previously are so simple that even in 2013 — WaPo understood the math.

So what changed?

The Federal Reserve creates more dollars, which reduces the current value of each dollar already in circulation. It is supply and demand, but of money. It takes a long time for any cause-effect case to be felt. Everyone from the producers of raw materials to those who sell finished products increase prices across the board, because there is more money sloshing around the system. So — what is the answer to those who claim that corporate price gouging is the culprit behind inflation? Corporations are not entrusted with the ‘dual mandate’ of the Federal Reserve — which is to keep both ‘inflation’ and ‘unemployment’ contained. Today, in order to combat skyrocketing ‘inflation’ — the Federal Reserve is forced to…

… DETONATE employment along with the entire economy?

There are many conditions being set and factors at play that are about to have a devastating impact on the average daily life and checkbook of every American citizen that need to be made abundantly clear.

Interest rates are going to continue to climb, for a time.

Buying a home? Selling a home to buy a home? Financing a car? Taking out a loan? Paying your credit card bill? Thinking about borrowing money from the bank to do home improvement projects?

The ‘cost’ of money [debt] is going to increase. Every major purchase has already become substantially more expensive due to higher interest rates — but it’s liable to continue trending in that direction for a long time to come.

If we isolate, for example, a slightly lower than median price a first-time homebuyer would pay for a home worth $300,000 — on average, they will already be forced to [waste] pay an additional approximately $700 per month. Should interest rates rise to 10% — that number will approach something more like $1100 per month. This destroys the financial model that many first-time home buyers are working with. In combination with other cost increases, this might even destroy most current homeowners, because it is impossible math.

Interest rates might ‘whiplash’ up and down, for a time, but will remain markedly higher than years past for a prolonged period of time.

In the 1980s – buyers had to deal with interest rates on homes upwards of 17%. It’s plausible they will have to be jacked that high again to deal with the inflation that is yet to arrive — but that is a forward looking statement and nothing can be predicted with certainty. What you can bet on is if there is continued massive government spending being pushed through, this will continue to obliterate the value of the dollars in your pocket. In a way, it is a stealth taxed — passed along from the Federal Reserve — to you, the wage-earning, tax-paying general public.

Inflation isn’t going anywhere.

Now that we’ve started this super-cycle of inflation, it’s here to stay. It’s not going to slow down, despite what media or financial reporters claim. It may whiplash up and down, and certain areas or subcategories of products may temporarily become cheaper for a time, but on the whole — items are going to cost a lot more in exchange for your present-day US dollars.

As a working example — take a round number such as $10,000.

Q: How many gallons of gas can you buy and reasonably store with $10,000?

A: It depends how much gas costs that day, and if you can find $10,000 worth of gas. The small fluctuations in price differentials from gas station to gas station, in aggregate, matter.

You may even see news articles with headlines such as:

“Food inflation comes down again in October.”

Why is this ‘Technically Bullshit’?

The RATE of increase has slightly gone down, but prices are still rising.

This is like saying “Food prices have come down” when they’re up record numbers year over year and are still going up, just not as fast.

If you thought gas prices were high during the summer, give it another few months.

As soon as the Strategic Midterm Oil Release ends, prices are going to start to rip higher than ever before. Remember when gas stations were getting ready to display $10.00+ gas prices? It takes time to do that.

The wise gas station owners of California have long been preparing for $10.00 gas prices. It takes time to put up new electronic billboards. You have to order it long in advance — especially with issues like the ‘chip shortage’. The machinery that runs the gas station can charge you over $10.00 a gallon for gas — it is simply the marketing and public display layer which has yet to catch up to reality. Optically, it’s not going to be pleasing.

Could OPEC and Putin, already pissed at Biden and the USA for far too many reasons to list here, coordinate and cut production even further causing the price per barrel to reach $200? $300?

Can the United States economy function at all with $300 oil? Remember, Saudi Arabia won’t be charging its citizens this rate, so the citizens of Saudi Arabia will likely be fine, but this is a nonstarter. Can the United States actually function with the price of one barrel of oil at $300? Economic activity would, for all practical purposes, immediately fall off the face of a cliff. This question should be driving your economic decisions for the next 24 months.

What would the price of a gallon of gas be with $300 oil? This question should also be driving your major personal economic decisions for the next 24 months.

Check out this article from 2009 — during the ‘Great Recession’ (whose problems remain with us to this day) — about what “inflation-fueled chaos” $200 oil could bring. Remember — oil producing countries will make more revenue despite the lowered supply. The only question now is: what is stopping them from activating this win-win proposal? Timing? Politics? The preponderance of US dollar denominated trade and exchange?

How does this tie into food, and the looming famines?

The oil-rich nations of OPEC would actually increase their revenue at that price level, and no domestic production will happen with Cryptkeepers like Biden running the Federal Government, and root vegetables like Fetterman holding political office in states with massive amounts of car-juice just below the ground.

Remember — the working thesis is that these people are actually trying to obliterate the economy. They just might get their wish.

In order to obliterate the US economy — what is specifically needed is for the preponderance of US dollar denominated international trade to end — to be replaced by Chinese, Russian, and perhaps a basket of other currencies.

This is the ‘New World Order’ that Putin talks about in his speeches. It is an order where the Cryptkeeper Biden and his henchmen do not get to unilaterally set financial or geopolitical policy that Putin or Xi Jinping have to follow along with. Whether there is a financial and economic or kinetic war actually matters very little in this instance — so long as US and aligned nations are no longer the sole Apex Predator in the room setting rules. There simply need to be Apex Predators — plural.

The ‘New World Order’ is India and China buying Russian gas in roubles — or entirely electronic Chinese cash without exchanging a single US ‘petrodollar’. This process will dramatically slow the velocity and demand of US dollars in aggregate — and is a direct attack on the financial system and stability in the United States. Ultimately, this phased process is going to destroy the international US dollar-denominated system much faster than any of the domestic issues we have here — whether that is forced genital mutilation of children, or the vaccinated having to go to chemotherapy for their ‘rare’ and ‘uncorrelated’ tragical and sudden aggressive cancers.

As screwed as the United States may look at this point — a simple look at a few other currencies paints an even more disturbing picture.

If you live in Japan and want to buy something made in the United States — barring pesky things like tariffs and taxes — you’re going to have to pay for it. These 3 graphs are 2 years of currency converted between hosts — the Pound, Yen, and Euro — and into Dollars.

What you are looking at is the average individual in Japan taking a stealthily instituted 25% haircut.

Suppose a Japanese person had — each paycheck — converted the full sum of their Yen pay into US dollars for the last 2 years. They would be up approximately 25% on that bet if they were to convert that money back into Yen. That is abnormal — currencies are not supposed to fluctuate at these levels. It is an indication that something in the current world order of financial systems is amiss. That is a massive depreciation in a very short amount of time for the Yen. In England and countries that use the Euro — this depreciation is less — but still massive. The dollar is “1950s strong” in comparison — and yet, due to our homegrown inflation, we are still going broke at the gas pump and at the grocery store.

Japanese printed inflation, however, is at recent record highs of around ~3%.

United States printed inflation (the real Big Lie) is at 8% yet is more likely really at 15%, or perhaps substantially more.

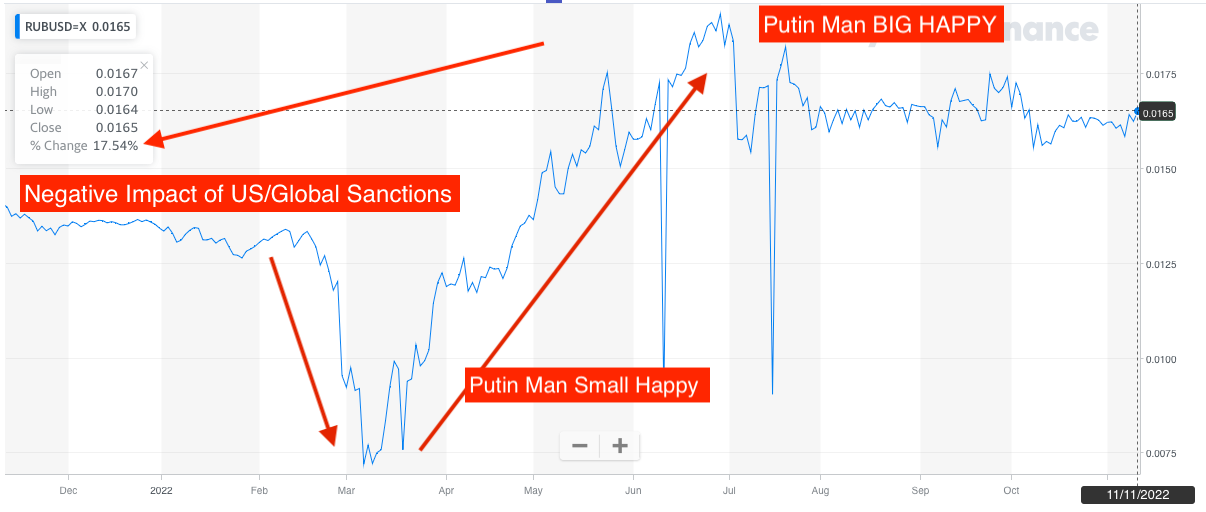

Now, do Russia

One of these charts is not like the others. Russian currency is up 17% in one year versus the dollar? But how can that be?

Why is Russian currency up so much? One of the reasons is simply put: Demand. Countries like China and India never cared or respected the idea of unilateral Western sanctions against Russia, so there is increased demand for Russian currency in order to trade for Russian natural resources like gas.

It appears as though the economic ‘experts’ placing the sanctions in the first place — intended to harm the Russian currency — made the Russian currency they were sanctioning even stronger.

Is this data accurate or meaningful and can one make any sense of it, one way or the other? Yes.

What would a plan look like that can help to avoid potential missteps (or unforced errors) by the Federal Reserve and shortsighted politicians in the months and years to come?

Subscribe for more.

Absolutely insane. And you’re correct, even I can tell something is very amiss with the financial systems.

Accumulate gold as it falls in the coming months, at 1690, 1590, 1490, 1390, 1290. Then sit on it as it tracks sideways and only sell enough in 3-month increments to have currency to live off of. Forget about keeping your net worth in any new / old / fiat / digital currency.