There are deep, structural issues with every aspect of the modern global finance system. Starting from the Board level, extending into the C-Suite, the tentacles of which break off and land at the ‘regulatory’ agencies — which possess within them an incestuous set of revolving figures out of companies like Goldman Sachs, JP Morgan, and other so-called ‘marquee’ banks. The institutional decay & rot is so deep, it’s hard to put into words.

After driving the banking system off a cliff in 2008 — and duct-taping what remained of the husk of the system — we are reaching the next phase of debacle. Bank runs, bank collapses, bank pandemonium — a crisis supposedly managed by the institutional rot created by legislators and …an industry of banking lobbyists.

Nowhere is this more obvious than in the case of Former Representative (D-MA) & now former Signature Bank board member Barney Frank. His namesake legislation — the Dodd-Frank Act, passed in the wake of the 2008 Global Financial Crisis, created organizations and structures which were supposed to focus on preventing these types of crises from happening.

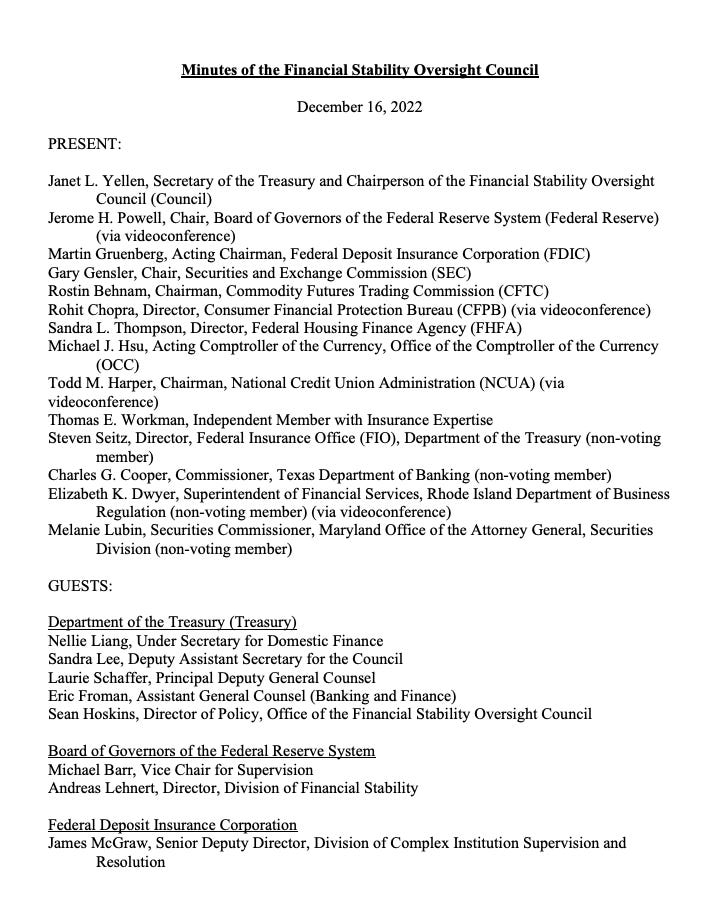

One of these organizations — the Financial Stability Oversight Council (the FSOC) — is supposed to meet quarterly to prevent the very type of crisis that is now unfolding. Obviously, if they do nothing, then these crises will be permitted to metastasize into Turbo Banking Cancer. Here’s the list of people at the meeting:

And there’s a whole second page of attendees.

Here is their agenda:

What’s interesting is that there’s limited discussion about the risks of the traditional finance system — but loads of pontification on other topics.

Instead of assessing the health of the now cascading failures of banks — this organization seems to babble on the risks posed by digital assets:

The Chairperson introduced the first agenda item, an update on recent market developments related to digital assets. She introduced Leslie Conner Warren, Digital Assets Specialist at the Federal Reserve Bank of New York.

Ms. Conner Warren stated that she would provide an update on developments related to the bankruptcy of the crypto-asset exchange FTX and its implications for digital assets. She began by noting that FTX and over 130 of its affiliates had filed for bankruptcy on November 11 following a run on its platform. She noted FTX’s affiliate LedgerX, which is regulated by the 4 CFTC and remained solvent, was not included in the bankruptcy filing. She noted that contagion resulting from these events had been concentrated within the crypto ecosystem.

Ms. Conner Warren said that crypto-asset prices declined by approximately 20 percent in the immediate aftermath of these events. She stated that the impact to the financial system had been limited to firms with direct ties to FTX and crypto assets, and noted that financial stability had not been affected. She stated that this outcome was consistent with the assessment in the Council’s report on digital assets, issued in October 2022, which noted that while the interconnections of crypto-asset activities to the traditional financial system were relatively limited, such activities could pose risks to the stability of the U.S. financial system if their interconnections with the traditional financial system or their overall scale were to grow without adherence to or being paired with appropriate regulation […]

The problem with organizations like this?

They functionally do nothing until there is a crisis, and then make the wrong decision regarding what to do to fix it. And so, with expensive Ivy League educations and your tax-dollars financing what amount to luxury trips back and forth across the United States (most of which they view as flyover country — which itself is masquerading as business travel — these are the individuals entrusted with ensuring that complex financial institutions have sufficient guardrails as to not constantly implode. Clearly, they are failing in this role again — and this is simply the opening salvo in the apparentness of that failure.

Instead, this organization (and many others) devote a large portion — of what is ostensibly limited time — to climate change initiatives. Tucked away on Page 10 of the most recent meeting minutes is this excerpt:

Climate change.

Not bank health.

Not risk exposure or appetite.

Not liabilities. No metrics on how many banks have sufficiently filled senior internal risk positions that, you might think, should be regulated by now, if anything was going to be regulated. No discussions about assessing the health of banks or intra-system liquidity.

Climate change.

You can find more of their meetings here, conveniently hosted for nobody to look at on the Treasury website.

Obviously, the endeavor of joining the board of a now-failed bank in receivership was a failure for Barney Frank. Just as the failures of his supposed regulatory changes will soon become apparent to anyone with a pulse.

And now they’ve lost control.

If you thought the response to COVID-19 by ‘health authorities’ was bad, just wait until you see the full response to BANKING-23 (& beyond) by ‘financial authorities.’

There are trillions of dollars of unsung debts sloshing around system wide — and the interest payments on that debt are soon coming home to roost.

I think I said this before, Keep Your Powder Dry. The roller coaster is running out of track.✝️🇺🇸

It's called finflation: inflation of financial assets, the biggest bubble in history, which will be exploded just in time to impose CBDCs:

https://scientificprogress.substack.com/p/the-plan-revealed