MAJOR ECONOMIC WARNING: How the Federal Reserve is Creating Conditions for Total Economic Devastation

Detailed overview of how rapidly rising interest rates have nearly always historically preceded substantial economic turmoil.

The United States has already technically entered a recession.

Granted — we’ve entered a recession as of the previous definition of recession, before it was conveniently changed prior the recent and suspiciously long-running midterm election cycle to benefit the incumbent illegitimate and Occupying Government. Basically, the powers that be have declared that for now, there’s nothing wrong. The economy is totally fine. Trust us, we’re experts.

In reality, the downturn is just beginning — for now, it’s only large mega-cap tech firms like Twitter and Meta making mainstream headlines as they lay off 1000’s of employees at a time — and VERY SOON many other forward-thinking companies will be tightening their belts as well.

Layoffs in other sectors are likely to begin as a trickle, and develop into a historic flood. When people start losing their jobs, maybe the economists at the Federal Reserve will declare it is a recession.

The remaining questions are:

How bad is the downturn going to be this time? (Not possible to predict.)

When is economic pain REALLY going to begin? (Not possible to predict.)

What is going to trigger a crisis of confidence in the investor and media networks where they actually ‘say’ it is happening ‘now’ vs. the present hesitation to admit there is even anything amiss. (Probably right after people start losing their jobs.)

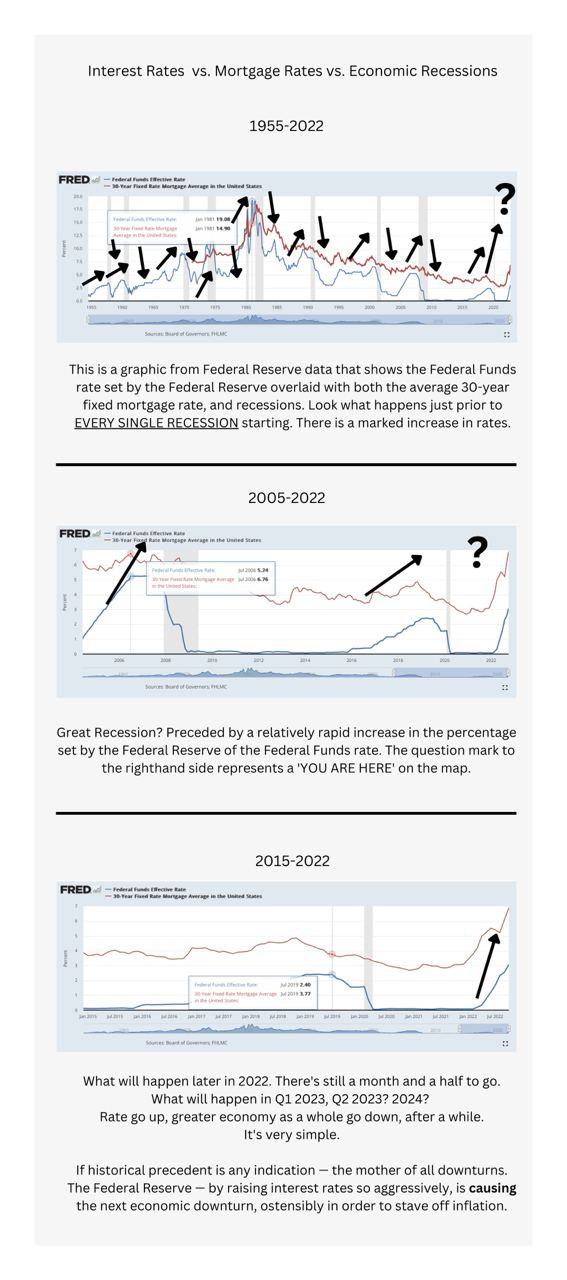

Below you’ll find a series of graphics, set to different periods of time, that can help with this thesis.

Note that because we are technically already in a recession, the right-most section of the graph should be gray — as that is how recessions are traditionally marked — but because the definition of recession was done away with (two sequential negative GDP prints) for political purposes, the graph has not gone gray yet.

Note: The small and most recent gray area in 2020 — a recent detonation of the economy — is due to Federally and State imposed COVID lockdowns.

It is GOING to become gray and it’s simply a matter of time before it is acknowledged as consensus.

Feel free to pull the data yourself without my annotations here:

https://fred.stlouisfed.org/graph/?g=l64N

Structurally, after 2008, none of the fundamental issues with the system were fixed.

To greatly simplify: all of the cans were kicked down the road, but now they are coming home to roost.

Has the Federal Reserve been deliberately causing detonations in the greater economy as a result of its complete incompetence or as part of a larger, more coordinated, plan?

What do you make of the Tom Luongo thesis viz the Fed and Powell specifically?