Economic Disaster: Secondary Impact

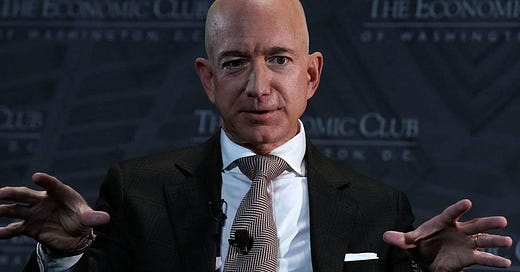

Even Bezos is now warning about how bad things are going to get, but even he might not know...or be forthcoming about it.

In a previous piece here:

A case is laid out that the only missing puzzle piece which will formally trigger either a ‘recession’ or a ‘Superdepression’ is a consensus on the state of the system as it stands — on a structural level — by business leaders, in board rooms, and by consumers (whatever is left of them). After what amounts to 20-30 years of the federal government printing and spending money compacted down into just a few years time, it comes as no surprise that after the flash (the stimulus — printing) comes a fireball (the inflation) and sometime later, a bang (the downturn.)

The result of this, as far as traditional braindead ‘Modern Monetary Theory’ logic is concerned, is that all of this government-led spending should ultimately lead to economic growth.

Pro-tip: it has not, that’s why fiscal deficits, debt-to-GDP ratios, and government debt levels have continued to climb unabated. That’s why years ago, unsound European economies like Portugal, Italy, Greece, and Spain defaulted on their debts. These same countires then unveiled a policy of “austerity” — substantially cutting social spending and services across the board.

Keep reading with a 7-day free trial

Subscribe to The Farm to keep reading this post and get 7 days of free access to the full post archives.