2023: The Year We Learn About "Enterprise Fraud" Constructs Firsthand

How to see the 'scale' — when the scale is ultra-massive.

As a working example of a meta-analysis..

You must learn to spot an “Enterprise Fraud” construct early, and how to source out those countering them.

With permission — former Green Beret and current PanFaWar student Michael Yon is allowing me to share this bit with you (bold my emphasis):

Go online and spend an hour shopping for food. You will see tons out of stock. I just finished reading another famine book last night. We are going through the substitution, reduction, crime increase phase I see in all these books. There are no names for these phases. Nobody seems to have made a phd study on famine. So I call it reductions, substitutions, crime phase.

More theft

Reduction of all sorts of consumption

Substituting what you want to for what you can get, or can afford.

In advanced stages, many items not available at any price. And remember…we are bidding against EXTREMELY wealthy people, nations, entities. Some giant entity might suddenly buy billions of dollars worth of food and take it off the market for now. Literally buy ships at sea. Ships filled with fertilizer or grain or whatever. Just buy it. These things happened just less than two years ago and will happen again.

If 2008 was an “Enterprise Fraud” construct that pitted consumers taking untenable positions on homes they soon would be unable to afford…leading to a cascading failure of the underlying “financial products” bought and sold by institutional banks…

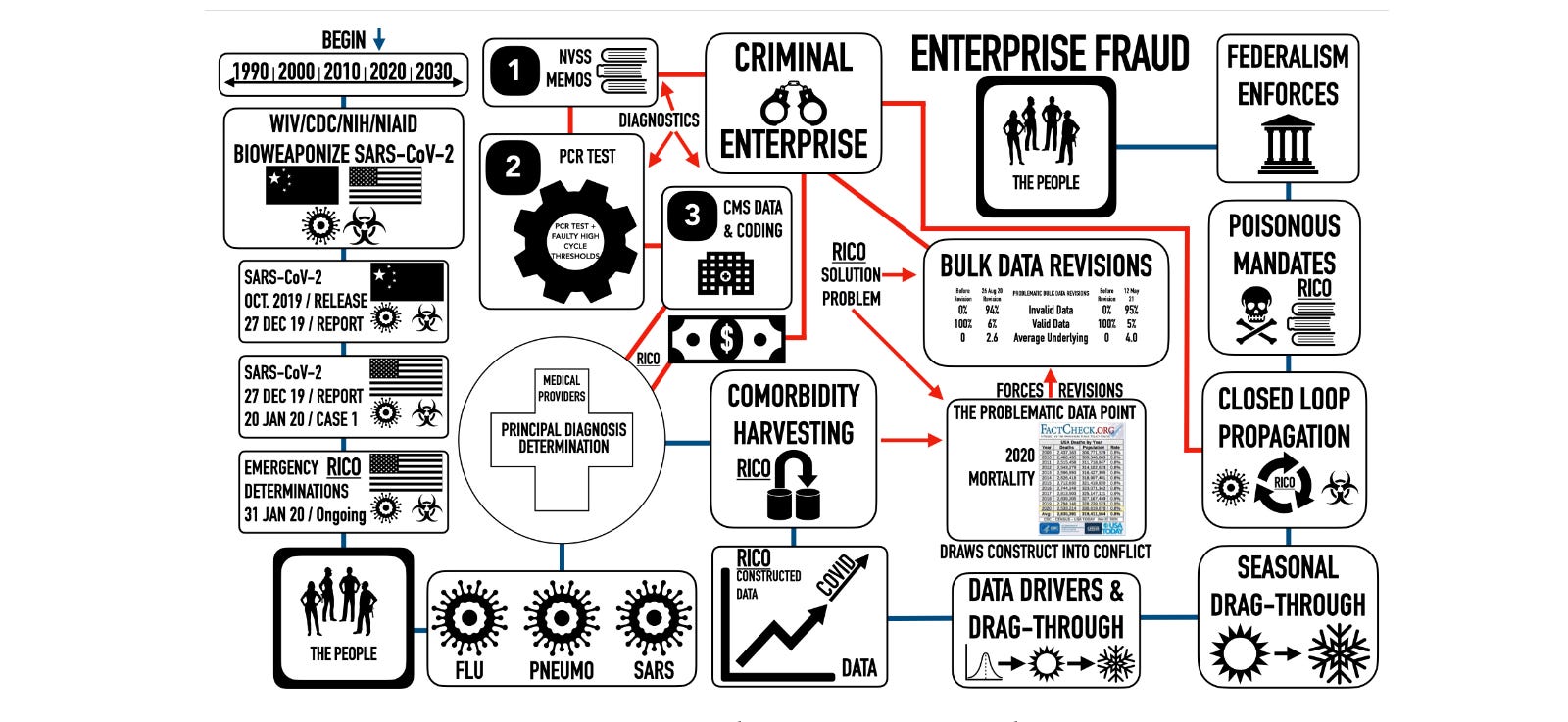

If 2020 represented an “Enterprise Fraud” construct that pitted the FDA, CDC, NIH, NIAID, Darpa, and whoever else was busy cooking up “Merna” kill shots against those of us who aren’t ready to hop off the edge of a cliff into the vaxbyss.

Then 2023 will demarcate the “Before Times” from the “Enterprise Fraud” construct that topples all others.

The investor class can bid on and buy up food, energy, industrial precursors, and whatever else they please while it’s..

STILL. IN. TRANSIT.

You can’t.

It’s not unreasonable at this point to reasonably expect wildly explosive institutional-backed runs on in-demand necessities. Oil, LNG, food, fertilizer — it’s all up for grabs. If a particular investor finds some data that says there’s going to be a food shortage — they’ll be front-running your trip to the grocery store. It has already started — but the pace is set to rapidly accelerate.

It’s no different from the concept of arbitrage, front-running a stock trade, or picking someones pocket with a smile— but conducted with oil. Or food. Or liquid natural gas.

Who voluntarily remains at the mercy of thieves?

We’re about to find out.

Read this — diligently — then go join Michael Yon at the links included.

Then read this — diligently:

Expose the death-cult all day every day.

You can find Yon’s feed on Substack here:

Political Moonshine does a stellar job of laying out a case for the overarching concept of “Enterprise Fraud” as applied to the COVID-19 swindle below.